Physical Address

Pros: Nothing comes close to the sheer number of scholarships that can be found through online scholarship databases. Chances are, your child’s background information will meet eligibility criteria for hundreds of scholarships.

College Math: 12 Tactics to Get the Most Financial Aid

The good news for college-bound students and their families is that increases in education costs are slowing, according to the College Board. The not-so-good news is that the price for a college education still has increased 17% for private institutions and close to 30% for public institutions since 2007, pushing average tuition and fees for the 2014-2015 school year to $31,231 for private four-year schools and $22,958 for out-of-state-students ($9,138 for in-state students) at public four-year schools.

It doesn’t take an advanced mathematics degree to figure out that a majority of students and their families will need some form of financial aid — loans, scholarships, grants, tax credits and the like — to get through college. Indeed, according to the College Board, about 60% of students who earned bachelor’s degrees in 2012-13 graduated with student loan debt. Undergraduates received an average of $14,180 in financial aid in the 2013-14 school year.

All of which makes it vitally important for college-bound students and their families to leave no stone unturned in an effort to reduce the financial burden that typically accompanies a college education. “Just a little bit of research and work can save thousands of dollars a semester,” says financial planner Hank N. Mulvihill, Jr., CFP® principal at Mulvihill Asset Management in Richardson, Texas, and an expert in college education finances. “The money is out there. But it takes effort to find it.”

Use the following tactics to help in the pursuit of financial aid dollars:

- Be an information sponge. The more you know about financial aid, the better positioned you’ll be to take advantage of funding opportunities. Websites such as www.savingforcollege.com, https://bigfuture.collegeboard.org/pay-for-college (from the College Board), the U.S. government’s Federal Student Aid site at https://studentaid.ed.gov/, and www.finaid.org are good starting points. It’s also worth consulting a financial planner with expertise in college funding. Find one in your area by visiting the Financial Planning Association’s national database of financial experts at www.PlannerSearch.org.

- Parlay high marks in high school into funding help. A lofty high school grade point average can translate directly into grant and scholarship money — or as Mulvihill terms it, “an $80,000 gift” to apply to college costs.

- Search diligently for scholarship and grant money. From individual companies and professional/business groups to community organizations, government entities and religious groups, a wide range of public and private sources offer scholarships and grants. “And stunningly, many of them go unrewarded,” says Mulvihill. “In some cases, really all you have to do is ask.”

Also check out the National Association of Student Financial Aid Administrators’ site at www.nasfaa.org/students/About_Financial_Aid.aspx. It also offers a free downloadable guide, FAFSA Tips and Common Mistakes to Avoid, at www.nasfaa.org/EntrancePDF.aspx?id=3783.

It’s a good idea, says Mulvihill, to practice filling out the FAFSA application before actually going to the FAFSA site to fill out the real thing. Visit https://studentaid.ed.gov/fafsa/filling-out for a walk-through of the process.

Follow these tips to get the most aid for your rising student! For money management tips for college aged kids, see our article: Top 10 Money Decisions for Today’s Incoming College Freshman.

The Ultimate Guide to Finding and Winning College Scholarships

A hands-on primer to helping your child earn thousands of dollars in free money, eliminate college debt, and live with less financial worry

Part 1: Introduction

Part 2: Where and when to search for and find scholarships

Part 3: How to apply for—and win—college scholarships

Part 4: What to do after receiving a scholarship award

Part 5: Frequently asked questions

Part 1: Introduction

Perhaps the only thing more stressful than getting into college is finding ways to pay for it. You’ve read and heard stories about families taking on significant debt just to put their children through college. This debt can take years—sometimes decades—to pay off.

On the other hand, you may have also read and heard stories about families whose children graduated from college completely debt-free. Students who receive enough financial support to attend and graduate from college with no debt can:

- Focus more on school and building lifelong relationships, and less on working for pay.

- Pursue their dream career rather than be handcuffed to less desirable but higher paying jobs simply because they have to make massive loan payments.

Nevertheless, being part of the debt-free club doesn’t just happen. After all, unless your child is part of the academic elite (that is, in the top 1–10 percent in the country in terms of grades, ACT or SAT scores, and extracurricular accomplishments), they likely won’t get enough merit-based financial aid to cover all college costs. In fact, some colleges don’t even offer merit-based scholarships.

Similarly, unless your family can demonstrate great financial need, your child won’t get enough need-based financial aid to cover all college costs.

The good news, however, is that your child may not need to cover all college costs. Rather, after receiving some grants (i.e., free money) from colleges and federal and state governments, the remaining portion can be paid off with scholarships.

How much does college cost?

Let’s take a quick moment to review how much college actually costs, not just what we’ve heard out in the wild.

According to The College Board, the cost of college during the 2022–2023 academic year rose by 3.5 percent at private nonprofit four-year colleges, 1.8 percent at public four-year in-state colleges, 2.2 percent at public four-year out-of-state colleges, and 1.6 percent at public two-year colleges, after adjusting for inflation.

These increases brought current average prices up to the following:

Tuition and fees

- Private nonprofit four-year: $39,400

- Public four-year in-state: $10,950

- Public four-year out-of-state: $28,240

- Public two-year in-district: $3,860

Room and board, books, and other fees

- Private nonprofit four-year: $18,170

- Public four-year in-state and out-of-state: $17,000

- Public two-year in-district: $15,370

Total

- Private nonprofit four-year: $57,570

- Public four-year in-state: $27,940

- Public four-year out-of-state: $45,240

- Public two-year in-district: $19,230

Those are some big numbers. But, before you close your browser and run for the hills and away from the college debt monster, keep in mind the big secret alluded to a brief moment ago:

Most students will not have to pay the full listed prices (i.e., the sticker prices) of college tuition, room, and board. Some of this amount will be covered via grants. The rest of it can be covered via (avoidable) loans, (avoidable) work, and (winnable) scholarships.

In other words, it’s entirely possible for your child to graduate from college debt-free.

In fact, many colleges with the highest sticker prices—mostly private schools—can also be the most affordable. Their high levels of endowment allow them to cover a large percentage of tuition (or even the entire bill) for students who come from families with lower- and middle-class incomes. Prestigious schools like Harvard, Brown, and Stanford all promise free tuition to students under a specified income level. Money is not so much an issue for these schools; recruiting the top students is.

Why you and your child should focus your energy and effort on obtaining college scholarships

Reason 1: Financial ROI

Beyond the wonderful gift of receiving money your child and family will never have to pay back, it’s important to understand the incredible financial return on investment (ROI) on your time spent applying for college scholarships.

Back in 2014, the folks at Scholarship Opportunity completed a wonderful analysis to answer the following question: Are scholarships worth it? The answer was—and still is—a resounding YES.

Scholarship Opportunity found that the hourly wage earned by applying for scholarships—completing applications, writing essays, etc.—is $66/hour, or $516/day, which is much more than what most people ever make.

Therefore, if graduating with little to no debt is a major priority for your child and family, there’s simply no better way to spend your effort than to apply for as many scholarships as possible.

Reason 2: Prestige ROI

In addition to the incredible financial ROI provided by college scholarships, they also provide a “prestige ROI.”

Specifically, students who win one or more scholarships are more likely to win additional scholarships because their résumé will look much more impressive.

Think about it: if a scholarship committee evaluates two students with equal academic and extracurricular profiles, but one of the applicants has several more awards—scholarships or otherwise—listed on their résumé, which applicant do you think will receive the scholarship? Of course, the student with more awards!

One myth related to this point that needs to be dispelled is the idea that scholarship organizations may not want to fund students who have already won scholarships because they may feel those students already have enough money. In fact, the opposite is true: students with other scholarships represent a safe bet that the scholarship committee will be funding a superstar.

Reason 3: Scholarships often have less competition than grants

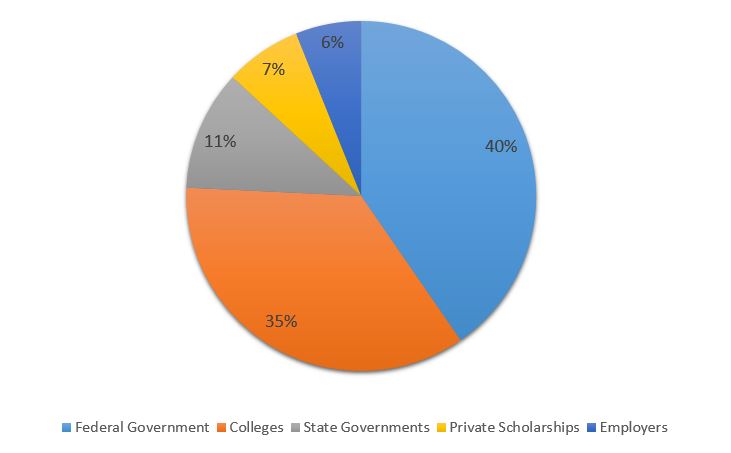

Let’s take a look at the following chart that depicts the percentage of scholarship and grant funding provided by various public and private entities:

As you can clearly see, colleges and the federal government collectively offer 75 percent of grant and scholarship money, much more than state governments, private scholarships, and employers.

After showing parents this chart during live seminars, I ask them, based on this information, where should they search for free money? Without fail, 95+ percent of them answer, “The federal government and colleges.”

Now, wherever most families will primarily look for college funding, that’s where the greatest competition will be. If we were talking about sports, competition would be a good thing. On the other hand, when we’re talking about a limited pool of free money, competition is the last thing we want.

Therefore, after taking the time to file your child’s FAFSA, I would encourage you to focus where few others are: private scholarships, including those from employers (more on this later).

Scholarships can help you eliminate college debt—and I’m living proof

When I started my freshman year of college at UCLA during the 2004–2005 academic year, tuition was $6,575.52. I received grants totaling $3,000/year, leaving a $3,575.52 difference. With scholarships, I covered that difference and then some, and was even refunded several thousands of dollars per quarter.

I transferred to Cornell University at the start of the 2006–2007 academic year, where the listed tuition was a much higher $31,881. Still, I received $29,000/year and offset the $2,881 difference through scholarships.

For graduate school, I returned to UCLA. Whereas my >$10,000 tuition was covered by the psychology department and outside funding agencies, I covered all of my living costs through—you guessed it—scholarships.

During my nine years of college and graduate school, I received over $200,000 in tuition support and stipends for living expenses through scholarships alone.

While tuition costs have gone up significantly since I started college—especially at public colleges and universities—the same tactics I used to graduate debt-free can help your family replicate my results today.

Who am I? My name is Dr. Shirag Shemmassian, founder and CEO of Shemmassian Academic Consulting. I’ve helped hundreds of students get into America’s top colleges and graduate schools. Moreover, I’ve helped many of these students significantly reduce—or even eliminate—their educational debt through scholarship advising.

When I share my story about graduating debt-free from Cornell University with my B.S. in Human Development and from UCLA with my Ph.D. in Clinical Psychology, I don’t do it to brag. Instead, my goal is to empower you so you can make college an affordable reality for your family.

Part 2: Where and when to search for and find college scholarships

Where to search for college scholarships

Have you ever heard people say something to the effect of: “There’s tons of free money out there! You just have to go find it!”? If you’re like most parents, you’ve probably wondered, “OK, so where is it? Where should I look?”

There are several different categories of places to look for scholarships, each with their own pros and cons. We’ll start with the most well-known places to search for scholarships and move toward the less well-known ones.

Given that each of the scholarship strategies described below have their pros and cons, I recommend you use them all to supplement one another, rather than exclusively rely on one or two.

Online scholarship databases

There are many scholarship databases online that compile thousands, sometimes millions of scholarships, and match your family to them based on your child’s year in school, GPA, state and city of residence, extracurricular interests, and so on.

Some of the most popular scholarship databases include Cappex, Chegg, The College Board, Fastweb, Scholarships.com, and Scholly.

Pros: Nothing comes close to the sheer number of scholarships that can be found through online scholarship databases. Chances are, your child’s background information will meet eligibility criteria for hundreds of scholarships.

Cons: The cons of using online scholarship databases aren’t exactly the databases’ fault. Nevertheless, I’ll describe them.

First, many of the scholarships found on these databases will end up receiving thousands of applications, simply because most families find scholarships through these websites. In other words, the competition for many of the scholarships is quite high.

Second, there are many “low-quality” scholarships found through these databases, such as those that have few eligibility requirements, whose primary goal is to collect physical and email addresses to send further promotions to.

Despite these cons, you can find several “diamonds in the rough” through online scholarship databases. Therefore, I recommend you include online scholarship databases as part of any college scholarship search.

College applications

While completing various college applications, your child will likely come across questions asking whether they would like to be considered for certain scholarships. Some of these scholarships opportunities are extended to all applicants, whereas others are only extended to students who meet certain eligibility criteria (e.g., state of residence, ethnocultural background).

Pros: Scholarship opportunities extended through college applications are the easiest to come across. To discover them, you simply have to go through the process of applying for college. If you’re reading this guide, you probably will or already have done that!

Cons: Again, given that these scholarships are so easy to find, many students will apply for them. While that shouldn’t be a deterrent, know that these scholarships will have greater competition for them.

School counselors

While a large number of scholarships can easily be found through online scholarship databases and college applications, many others aren’t listed in either of these sources. High school and college counselors may know about several scholarships not listed on larger databases that your child is eligible to apply for; all you have to do is ask.

And don’t feel limited to only asking your school’s counselor. Typically, counselors at other local schools are also happy to help you find great scholarships.

Pros: High school and college counselors are often able to point you to high-paying, low-competition scholarship opportunities that you simply wouldn’t have known about otherwise. They can also help you sort through the hundreds of scholarship opportunities you come across on online scholarship databases.

Cons: School counselors often have a large number of students they are required to support. Therefore, the onus will largely be on you and your child to approach them for help. Moreover, school counselors simply won’t know about the many scholarships listed on online databases, as well as niche scholarships you can find on your own (see the following section for more information). Therefore, you shouldn’t exclusively rely on school counselors for your scholarship search.

Manual searches for private scholarships

The greatest hidden gems are typically found through conducting manual searches for private scholarships (i.e., niche scholarships).

The best approach to finding private scholarships is to first list everything about your child’s and family’s background, including your ethnocultural background, place of employment, and place of residence, as well as your child’s gender, extracurricular interests, disability status, etc.

Next, you should conduct online searches via Google or similar search engines for every single item on your list to see what scholarship opportunities are available to your family. For example, if you search for scholarships for students with disabilities, you may come across Nitro’s awesome resource: 131 Scholarship Opportunities for Students with Disabilities.

In college, nearly all of the scholarship money I earned came from private scholarships I found through such manual searches.

Pros: Private scholarships typically have the lowest competition, for the following two reasons: they often don’t appear on online scholarship databases, and they have very targeted eligibility requirements (e.g., belonging to a specific ethnocultural group).

Cons: Finding private scholarships that your child is eligible for perhaps requires the most effort and creativity of all the listed approaches. Your search will be most effective after deep brainstorming about your child’s and family’s background.

When to search for college scholarships

I’ll break down this shorter section in two ways: the best time of year to search for scholarships and the ideal grade levels during which to search for scholarships.

First, what’s the best time of year to search for college scholarships?

Most scholarship applications tend to be due in the fall (October–November) or spring (March–May).

That said, several scholarship applications your child is eligible for will likely be due outside of these months. Therefore, it’s worthwhile to conduct a quarterly scholarship search and plan ahead.

And during what grade levels should you search for college scholarships?

Whether your child is in 10th grade, 12th grade, or in their sophomore year of college, there will likely be various scholarships they are eligible to apply for. Nevertheless, most scholarships require students to be in 12th grade or in college at the time of application.

How to stay organized with college scholarship applications

Keeping track of all of the great scholarship opportunities you find can be challenging. Therefore, I strongly recommend you stay organized with a spreadsheet containing the following pieces of information for each scholarship:

- Name of scholarship

- Scholarship website

- Application due date (and if submitting via regular mail, specify whether it needs to be postmarked or received by the due date)

- Eligibility requirements*, such as:

- Grade in school

- Race/ethnicity

- Citizenship

- Disability status

- Extracurricular activity participation

- Transcripts

- Test scores

- Résumé or CV

- Cover letters (including name and address of recipient)

- Essays (including the number of essays, essay prompts, and word or character count)

- Recommendation letters, including:

- The number of letters

- Types of letters (e.g., from a teacher or from a coach)

- How letters should be sent (e.g. uploaded to online application vs. mailed, mailed directly by recommender vs. included in larger application envelope)

*Please note that eligibility requirements can sometimes be confusing. If you have any questions or need further clarification whether or not your child qualifies for a certain scholarship, please get in touch with the scholarship organization immediately. They’ll be glad to help.